Full Time VS Flexible Staffing Recruitment Cost

مقالات ذات صلة

قد يعجبك أيضاً..

For Employers

Running out of ideas? | A Guide to Emotional Marketing in Retail and F&B

23 نوفمبر 2023•6 دقائق قراءة

For Employers

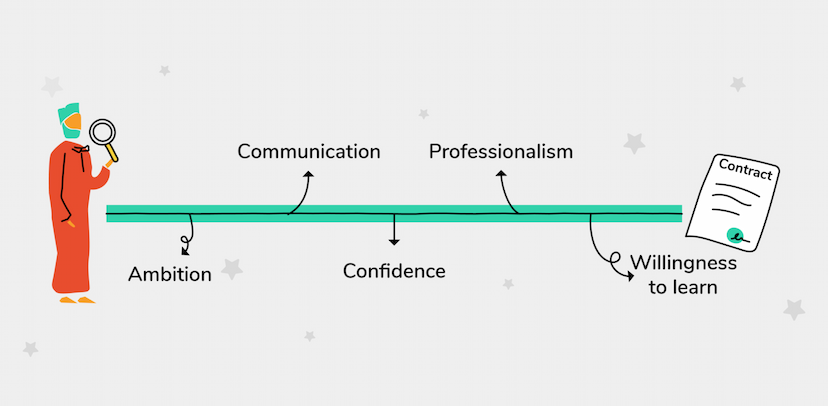

Fantastic Employees for retail and F&B | How to find them?

23 نوفمبر 2023•5 دقائق قراءة

For Employers

Guide: Onboarding and training for Retail and F&B staff from A to Z | Includes downloadable templates.

23 نوفمبر 2023•7 دقائق قراءة